ARCHLINE CAPITAL FAQs

What is a Syndication?

We SYNDICATE apartment complexes = we buy them with investors, operate them, distribute cash flow, and return additional profits upon sale and/or refinance.

SYNDICATION = a group of people pooling money together to buy an asset = most commonly a company or a real estate property.

There are 2 roles in a SYNDICATION

General Partner/Sponsor

The ones who coordinate with syndication: finding the asset, negotiating terms, pulling together funds, closing the purchase, managing the asset, distributing profits.

Limisted Partner / Equity Investor / Passive Investor

The ones who provide the money (Equity) in return for shares in the asset

Limited Partner Returns come in 3 forms

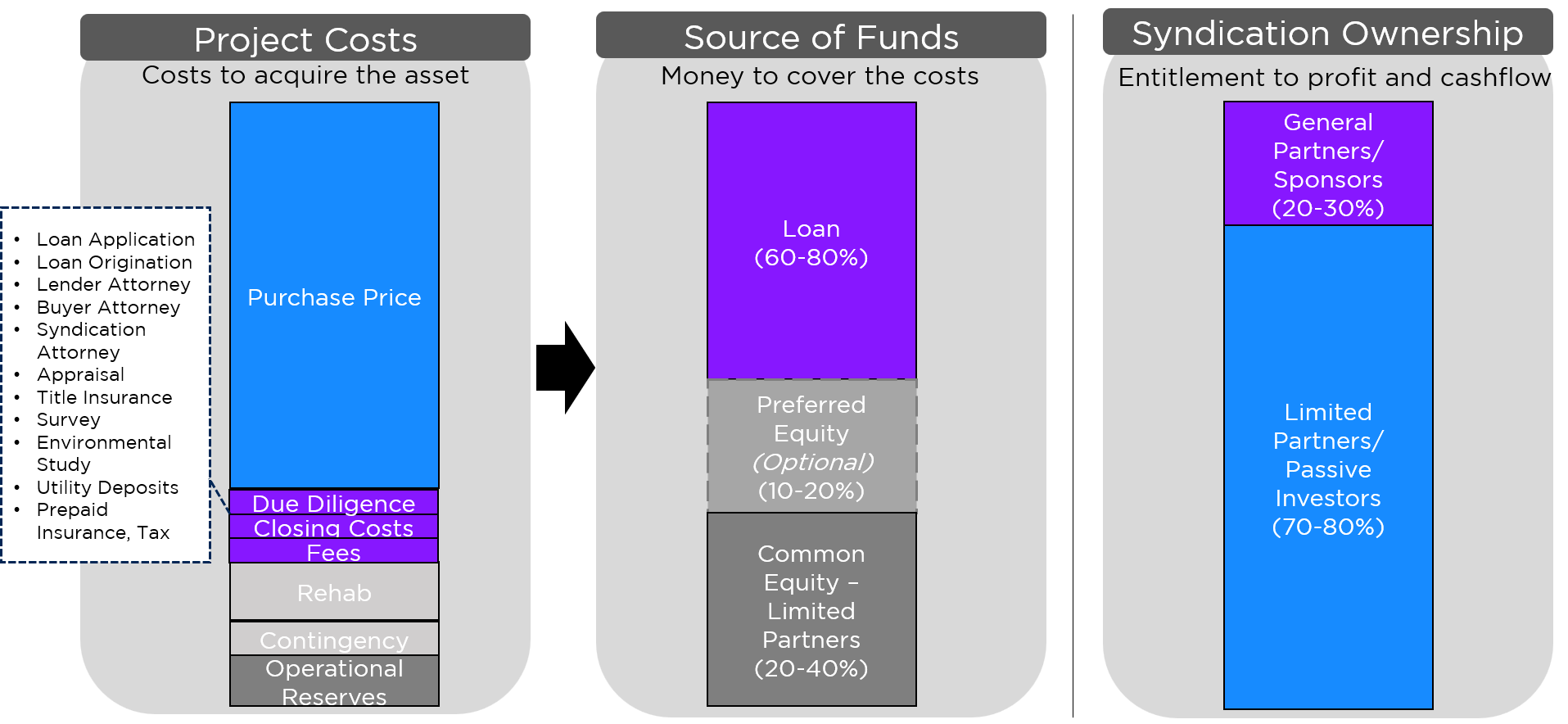

What does a Syndication Look Like?

Investment Details

Who can Invest in a Syndication?

You need to be at least a Sophisticated or Accredited Investor (per the SEC)

Some syndications are for ACCREDITED INVESTORS ONLY: Archline Capital syndications allow UNLIMITED ACCREDITED INVESTORS and up to 35 SOPHISTICATED INVESTORS that have a "Material, Pre existing Relationship" with the sponsor.

What is the MINIMUM Investment?

$50,000: it's not uncommon to see syndications with $100,000 minimum.

What kind of RETURNS can I expect?

First of all, be clear that while this has proven a reliable method of investing no return is guaranteed, we target and routinely see returns of 20-30%+ per year (tripling the stock market or better).

How is VALUE created?

Mutlifamily properties are valued on their Net Operating Income (NOI): VALUE = NOI / CAPITALIZATION RATE.

You create value from: increasing the income, decreasing expenses, or market demand increasing: a $1 increase in monthly income leads to a $200+ increase in value.